Analytics from Consilience

Revealing the unseen risks that are not priced into the market

At Consilience, we don’t just produce analytics for analysis sake; we don't theorize from ivory towers. We apply our methods in practice to deliver value-added solutions. DeepAlphaIQ showcases the power of Consilience applied to Finance.

DeepAlphaIQ, powered by Consilience, is revealing the unseen risks that are not priced into the market.

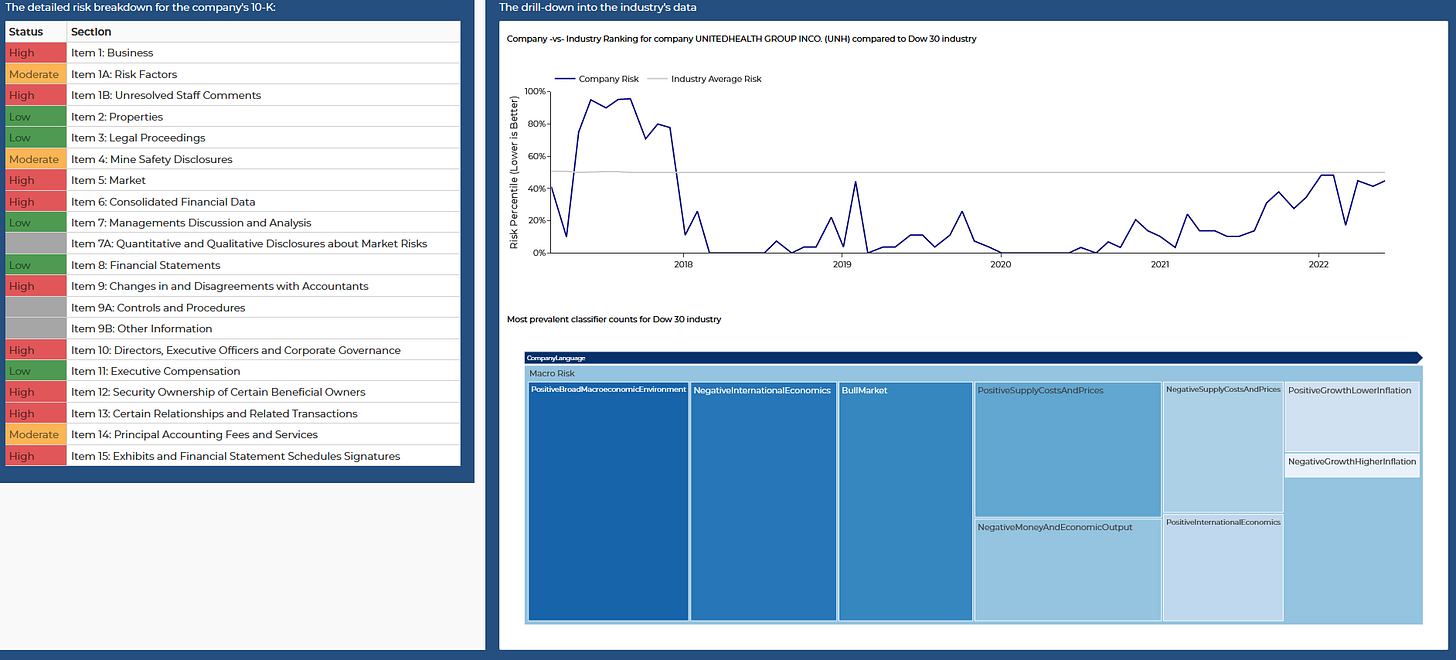

One of our solutions is EDGAR Watch - a tool for bottom-up analysis based on company language indicators derived from deep analysis of SEC filings.

Fed Watch - another solution from DeepAlphaIQ - reveals the unseen risks in the market by uncovering the hidden agenda of the Fed. Fed Watch is a tool for top-down forecasting of Effective Interest Rates and Fed policy based on language indicators from Fed meeting minutes.

Why We’re Here

We dwell at the places where math, physics, biology, philosophy, and art overlap, and we have a culture that emphasizes hard engineering over traditional computer science or IT. We care aboutreliability, so we reject statistical methods that require the use of samples, estimates, and uncertainties and that require a host of assumptions that break down in the real world. The Consilience Engine measures real relationships in the data. In that sense, what we do is far closer to physics than statistics. We care about explainability, so we employ first-principles mathematics and exclude methods that operate in black boxes and are subject to all the biases inherent in their training data. We care about ease of use, so we are giving the engine simple, intuitive UI and UX that will make the engine accessible to users with varying kinds or levels or expertise.

Interseted in diving in to the analytics Consilience has to offer?